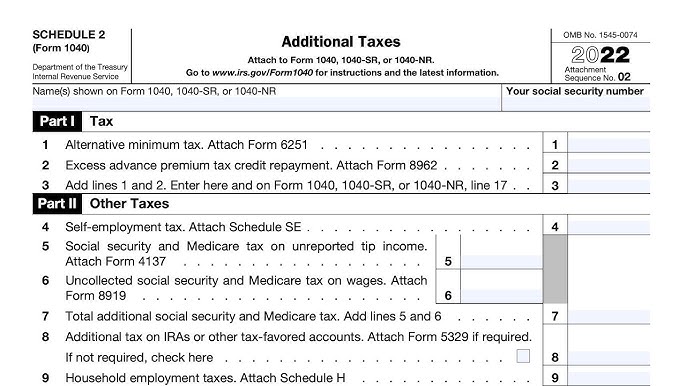

Irs Form Schedule 1 2024 Single – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com . Even though we’re well into February, it’s still possible that you might not have your W-2 yet. Here’s what to do. .

Irs Form Schedule 1 2024 Single

Source : m.youtube.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govIRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.com1040 (2023) | Internal Revenue Service

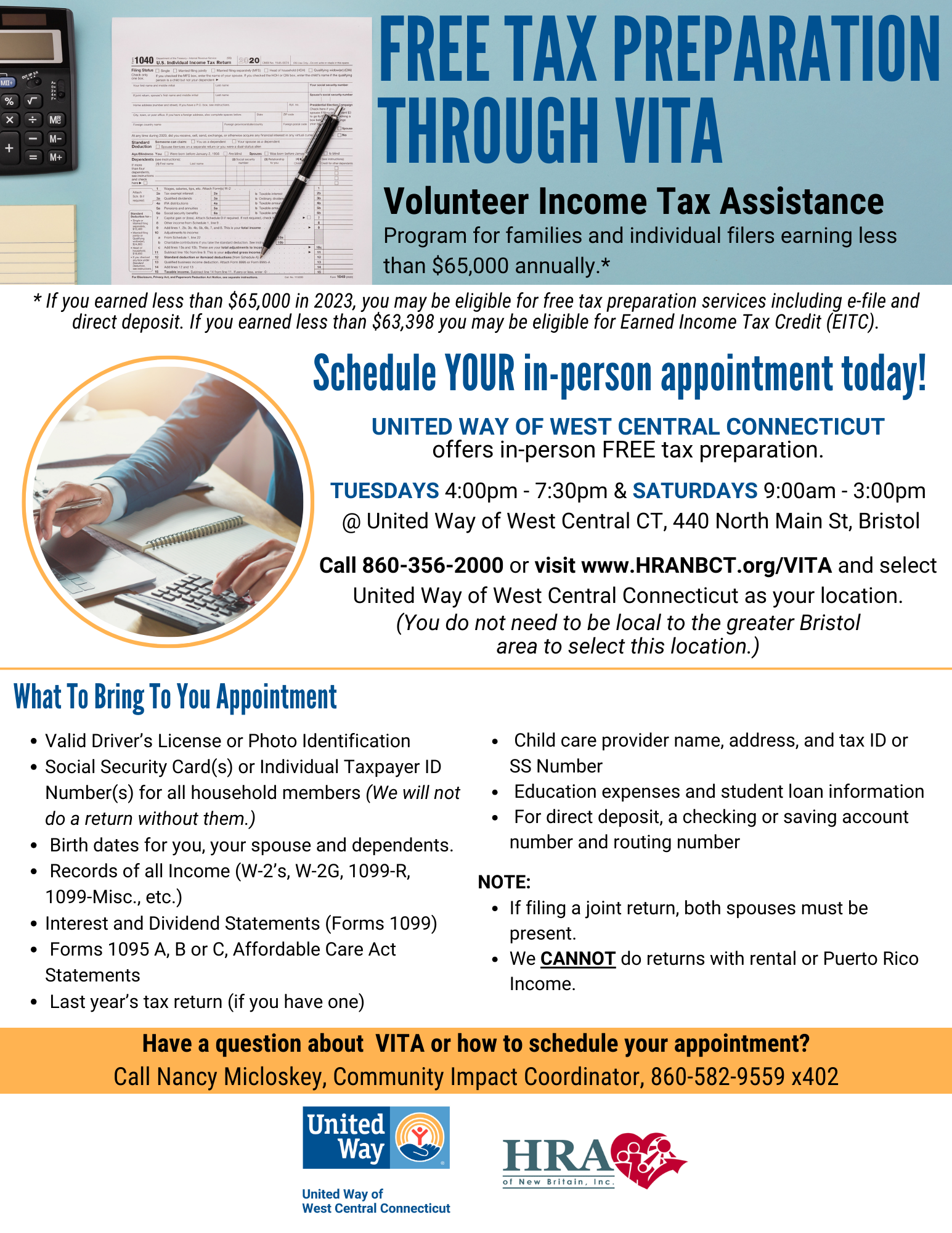

Source : www.irs.govFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.orgU.S. Individual Income Tax Return Income

Source : www.irs.gov2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.comReddy & Neumann, P.C. on X: “New Year, New Tax Returns💸 Dive into

Source : twitter.comTax season begins: What to know for filing this year | VPM

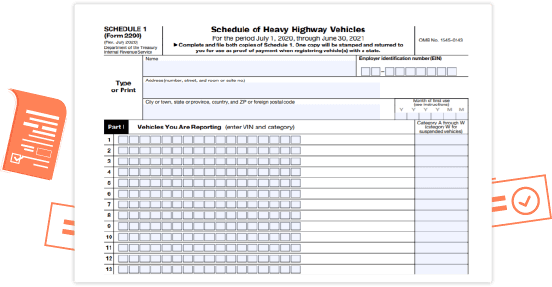

Source : www.vpm.orgIRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.comIrs Form Schedule 1 2024 Single IRS Schedule 1 walkthrough (Additional Income & Adjustments to : Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . Start Now For the 2024 tax season, the IRS has increased the standard deduction to $13,850 for single filers and $27,700 information required on the form. Taxpayers who receive these forms .

]]>